A field guide to the 2026 mega-IPO backlog: who’s closest to the window, what they’re really worth, and why this wave could reset comps, reroute flows, and reprice the tape.

Leer este artículo en español 🇪🇸

Markets don’t always turn on macro prints. Sometimes they turn on paper.

If 2026 delivers a sustained IPO window for late-stage private giants, we may be staring at a genuine liquidity reset: sector rotations driven by new supply, multiple compression/expansion as fresh public comparables emerge, and—most importantly—a hard, public reference point that forces private marks to reconcile with reality.

This edition is built for that moment: what an IPO really is, why the pipeline matters, how to separate signal from exit liquidity, and a focused radar of seven names whose debut could actually move markets.

Context: What an IPO is and why it’s not always the gift it’s marketed as.

An IPO (Initial Public Offering) is the process by which a private company becomes publicly traded by selling shares to public investors. Mechanically, most offerings include two distinct components:

- Primary issuance (cash into the company): funds growth, R&D, capex, M&A, or balance-sheet repair.

- Secondary sale (cash out to existing holders): funds, employees, and early investors monetizing their stake.

Tracking IPO candidates is valuable for three reasons that are, frankly, more about market plumbing than romance:

- Price as signal: a new public listing becomes an anchor for an entire sector’s valuation framework. One new mega-cap comp can re-calibrate multiples across public peers and private marks overnight.

- Flows and positioning: large IPOs reshape portfolios, factor exposure, and index math. Sometimes they force buying. Sometimes they force selling. Either way, they move flows.

- Cycle read-through: IPO windows don’t just reflect risk appetite—they often lead it. When underwriters can clear size at decent terms, the market is telling you something.

But here’s the part people forget: the same IPO can be a great business and a mediocre stock (or vice versa), depending on why it’s coming public.

The key distinction: growth equity vs. exit liquidity

The most attractive IPO setups typically look like one of these:

- The company is at a monetization inflection (product is proven, margins are expanding, operating leverage is starting to show).

- The runway is still long (TAM is expanding and unit economics are improving, not just top-line growing).

The less attractive setups tend to rhyme with this:

- The company is coming public because private capital got tighter, secondary markets dried up, or the cap table simply needs liquidity.

- The business is too mature—growth decelerating structurally, few credible margin/catalyst levers left, and the IPO is trying to sell yesterday’s narrative at today’s discount rate.

A “good” example: Reddit (when the price leaves oxygen)

Reddit is a useful reminder that a public debut can work when the offering price respects uncertainty and leaves room for the market to do discovery. A deal that doesn’t pretend volatility doesn’t exist tends to trade cleaner: more stable shareholder base formation, less immediate indigestion, better odds of building a real public multiple over time.

Two cautionary examples: Figma and Klarna

- Figma: the warning sign wasn’t “a bad company.” It was the way the tape behaved around the debut—when the first few sessions turn into an event, you often get the classic mix of limited float, aggressive early momentum, then a sharp repricing as supply and reality catch up.

- Klarna: the lesson here is valuation path dependency. When you’ve been marked at peak-cycle multiples, later rounds and public markets force a reconciliation. Even if the business improves operationally, the stock’s job is to price future cash flows, not to validate historical private marks.

The underwriting discipline that matters: before you fall for the ticker, audit three things:

- Growth quality (NRR/retention, mix, pricing, durability).

- Cost structure (what is variable vs fixed; how expensive is the incremental unit served).

- Motivation for paper (primary vs secondary; lockups; is the IPO funding an offensive plan or just clearing the cap table).

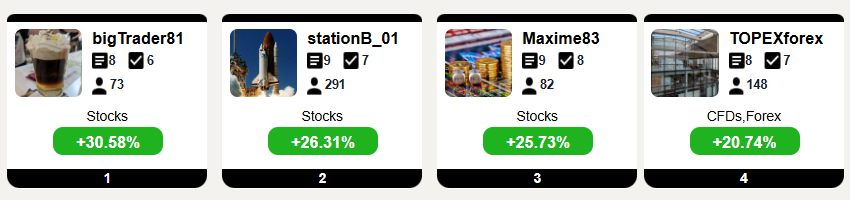

Top Traders League

The “hot” sectors for 2026—and why the hype has a rational backbone

If the IPO window stays open, narrative will cluster where technology meets capex and urgency. Four verticals stand out:

1) Robotics: leaving demos, entering measurable productivity

Robotics is shifting from “wow factor” to ROI per shift. Lower sensor/actuator costs, better perception and planning via modern models, and persistent labor constraints are turning automation into a financial decision, not a marketing one.

The market pays for robotics when it sees repeatable deployments, credible uptime, low failure rates, and a clear downward trajectory in cost per installed unit.

2) Aerospace: infrastructure, defense, and connectivity

Space is no longer purely exploration—it’s infrastructure. More frequent and cheaper launches plus connectivity constellations make orbit a physical layer of the digital economy. Add a geopolitically noisy cycle, and demand for resilient communications and dual-use capability becomes less optional.

Public-market debates here are brutally practical: capex intensity, replenishment cadence, regulatory friction, and scale margins.

3) AI: public markets don’t buy models—they buy unit economics

AI remains the capital magnet, but the conversation is maturing. The question isn’t “best model.” It’s:

- pricing power,

- enterprise retention,

- and whether inference costs fall faster than pricing.

In 2026, “AI IPOs” will get valued on gross margin after compute, durability of contracts, and defensibility of distribution—not on demos.

4) Finance / payments: monetizing volume without letting the cycle eat you

Payments and fintech re-rate when (1) volumes are healthy and (2) attach products expand margin: software, fraud, treasury, issuing, lending, wealth. But the sector reprices quickly because it’s exposed to:

- take-rate compression,

- fraud losses,

- and macro sensitivity via consumption and credit.

Translation: the hype has a basis, but public markets demand clean accounting and clean economics.

IPO Radar 2026: Seven private giants (valuation, thesis, and what to watch)

Quick framing: late-stage private “valuation” is a snapshot of the last financing or secondary print—often in a controlled environment. IPO pricing is a different animal: it’s a function of market window, deal structure, float, and who needs liquidity right now.

1) SpaceX — two engines: launches + Starlink

Valuation reference (private/secondary): market chatter has ranged widely via secondary activity; the bull framework people underwrite tends to hinge on Starlink’s scale economics rather than launch revenue.

Why it matters: SpaceX is effectively two businesses with different risk profiles:

- Launch: high barriers, rising demand, but contract timing and cost discipline matter.

- Starlink: potentially the real tape-rewriter if it becomes a scaled global connectivity subscription business.

Bull case

If Starlink compounds subscribers with durable ARPU and controlled churn, the market can start valuing it more like subscription infrastructure than “aerospace.” That changes comps and the multiple regime.

Key risks

- Capex and replenishment costs: constellation refresh is a permanent tax.

- Regulatory and geopolitical friction: spectrum, licensing, operating permissions.

- Execution concentration: capex-led businesses get punished when discipline slips.

What to watch

Subscriber growth, ARPU, terminal economics, capex-to-sales, and any transparency that separates launch economics from Starlink economics.

2) OpenAI — revenue growth vs compute burn

Valuation reference: late-stage discussions have floated very large numbers, but the single most important variable is not the headline—it’s gross margin after compute and the partner economics embedded in distribution and infrastructure.

Bull case

OpenAI can become one of the highest leverage software franchises if it turns product gravity into:

- sticky enterprise contracts,

- real pricing power through integration into workflows,

- and a cost curve where inference gets cheaper faster than pricing compresses.

The multiple hinge: partner economics

At scale, “AI margin” is a negotiation across the stack: cloud, chips, distribution, and revenue share. Governance and contractual structure can matter as much as model quality.

Risks

Compute dependency, competitive pricing, and governance/expectation whiplash—public markets tolerate less narrative volatility than private ones.

What to watch

Enterprise ARR and retention, net revenue expansion, post-compute gross margin trend, and contractual commitments for capacity.

3) ByteDance (TikTok) — cash machine with a geopolitical discount rate

Valuation reference: widely dispersed marks due to secondary prints and headline risk.

Bull case

If TikTok keeps monetizing attention efficiently and commerce ramps, it’s a monster: scale, engagement, and cash generation.

The risk is not operational—it’s headline-driven

Divest/ban/regulatory structure risk can hit valuation faster than any quarter can fix. This is a stock where the political tape can dominate the earnings tape.

What to watch

Monetization per user, commerce take rate and margin profile, and any credible resolution path on sensitive jurisdictions and control structures.

4) Anthropic — the “enterprise trust” AI bet

Valuation reference: recent late-stage rounds have put it in the top tier of private AI valuations.

Bull case

In enterprise AI, trust, security, compliance, and predictable contracts can win. If large orgs standardize on one model stack, renewals can become sticky and switching costs meaningful.

Risk: brutal unit economics

Growth that doesn’t convert into margin becomes a public-market problem quickly. If compute costs don’t fall fast enough, “usage” doesn’t equal “profit.”

What to watch

Conversion from usage to annual contracts, renewal rates, concentration risk, and post-compute gross margin.

5) Databricks — where data becomes fuel for AI products

Valuation reference: late-2025 financing pushed Databricks further into mega-cap private territory.

Bull case

Databricks wins when enterprises treat data infrastructure as strategic: governance, lineage, security, and the ability to serve AI workloads reliably. If customers expand workloads over time, you get operating leverage.

Risk

Consumption models can slow when budgets tighten. This one lives and dies by retention and expansion—NRR is the pulse.

What to watch

NRR/cohort expansion, workload mix, sales efficiency, and whether operating leverage shows up as scale builds.

6) Stripe — the quiet backbone of online payments

Valuation reference: secondary activity has suggested a strong recovery in private valuation versus trough prints, but the key driver remains volume + attach.

Bull case

Stripe compounds with scale, global expansion, and product attach (billing, fraud, treasury, issuing). The best version of Stripe is not a payments processor—it’s a payments operating system.

Risks

Macro volume sensitivity, fraud losses, and take-rate pressure in competitive corridors.

What to watch

Volume growth quality, net take rate, fraud/chargeback loss trends, and attach-rate expansion into software products.

7) Revolut — a global banking rollout disguised as an app

Valuation reference: recent transactions have anchored it at a large but still financeable private valuation.

Bull case

If deposits grow, product stacking works (cards, lending, wealth, subscriptions), and compliance scales cleanly, Revolut can deliver elite unit economics and multi-product ARPU expansion.

Risks

Compliance and regulatory scrutiny, plus credit cycle timing if lending expands into the wrong macro moment. In banking, reputational shocks are expensive.

What to watch

Deposit quality and stability, compliance signals, lending discipline (vintages, provisioning), and profitability by product line.

Closing: why tracking IPO candidates can be unusually lucrative right now

Tracking near-term IPO candidates isn’t entertainment—it’s edge management.

In a real IPO reopening, three things happen simultaneously:

- Comps get rewritten: one mega-cap listing can re-rate an entire group—up or down.

- Flows reposition: big offerings force rotations; understanding float, lockups, and calendar is alpha.

- The cycle reveals itself: sustained deal clearance signals a market willing to fund growth again—though on tighter terms and cleaner economics.

The opportunity is not “buy every exciting IPO.” The opportunity is being early to the right framework: great business, clean unit economics, rational price. IPOs punish narrative investors faster than almost any other venue because the market discovers the asset in public, in real time.

A question to leave you with—because it’s the one I think will define 2026 tape:

If growth risk-on returns, will the market reward the “perfect story,” or the company with undeniable unit economics—even if the narrative is less glamorous?

For real-time market context and IPO tape updates, follow us on X: @pro1xcom. And if you want alerts and analysis in your pocket, download the Pro1X app.