The first weeks under the Trump–Musk tandem in the White House injected hefty doses of volatility into the stock.

Yet Elon Musk’s recent pledge to scale back his political profile and refocus on day-to-day company operations has proven a strong catalyst for price action—but for how long?

Early this month, the 20- and 50-day moving averages triggered a bullish crossover, validating the powerful up-trend that began a couple of weeks earlier. An explosive rebound has lifted the share price more than $120 from the ~$220 trough printed just over a month ago. The $362 region now stands as the key upside hurdle. A decisive close above that level, backed by strong volume, would confirm a trend-continuation breakout with scope toward $400–420. Once there, Tesla would confront a dense congestion band.

On the downside, the $333–330 zone is first-level support. A break could spark an initial pullback, but only a daily close below the psychological $300 handle would materially jeopardize the short-term up-trend. Should that occur, the $265 area becomes the next objective, with a full retracement toward the $220 floor not out of the question.

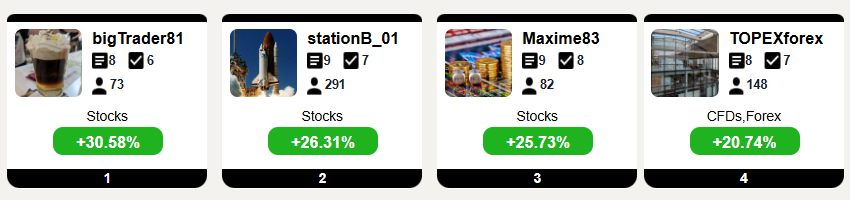

Top Traders League

Resistences: $362 • $400–420 • $450

Supports: $330–300 • $270 • $250 • $220

Targets: (bullish) $420 • $480 (bearish) $330 • $300 • $265 • $220 • $180

Tesla Trend Profile:

- Short term Bullish.

- Medium term: Sideways.

- Long term: Bullish.