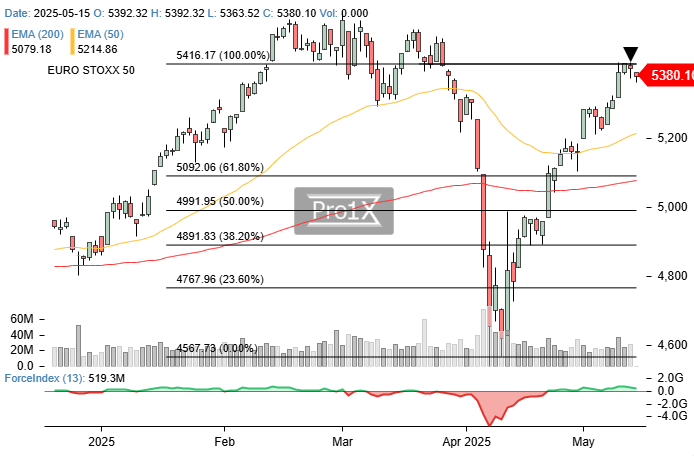

Eurostoxx 50 has rallied nearly 20% in just over a month. Is it time for a pause?

The 5.420–5.450 congestion zone—coinciding with the late-March bearish breakout gap—has, for now, arrested the spectacular up-move that began a few weeks earlier around the 4.600 level. The index is beginning to show signs of short-term weakness and trend exhaustion. The 5.200 and 5.090 marks—first short-term support and the first Fibonacci retracement (which aligns with the 200-day moving average), respectively—are now the key levels to watch. Any pullback that holds above these supports, especially the latter, would likely be interpreted as a healthy oscillator reset ahead of new highs.

Top Traders League

Access the full portfolios and technical profiles of Pro1X’s leading TopTraders.

Resistences: 5420-5450, 5500, 5560

Supports: 5300, 5200, 5090, 4990

Targets: (bullish) 5500 (bearish) 5220, 5100, 5000, 4890

Eurostoxx 50 Trend Profile:

- Short term Range-bound with an upward bias.

- Medium term: Bullish.

- Long term: Bullish.