How disciplined long/short structures translated relative moves into realized returns.

Leer este artículo en español 🇪🇸

In the first article, we laid out several long/short pair trades designed to take advantage of relative performance rather than outright market direction. The idea was straightforward: when markets lack clear trends, relative dislocations often offer cleaner opportunities than directional bets.

After several weeks in play, those trades have now run their course. Initial objectives were met, spreads normalized, and the broader market environment became less accommodating for this type of structure. At that point, closing positions was less a matter of conviction and more a matter of discipline.

Below is a review of how each pair evolved and what each one delivered.

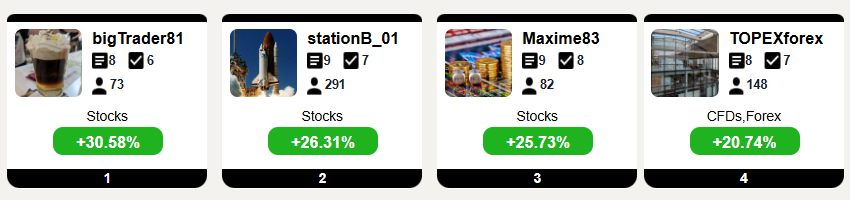

Top Traders League

Pair 1: Tesla (short) vs Microsoft (long)

Opened (12/18/25)

- Tesla: 483.37 USD (short leg)

- Microsoft: 483.98 USD (long leg)

- Position size: 50 shares per leg

Closed (01/09/26)

- Tesla: 445.01 USD

- Microsoft: 479.28 USD

Outcome

- Tesla (short): +38.36 USD per share → +1,918 USD

- Microsoft (long): −4.70 USD per share → −235 USD

Net result: +1,683 USD

The contribution came primarily from the short side, as Tesla corrected while Microsoft held up reasonably well. Once the relative move had largely played out, there was little incentive to keep the structure open.

Pair 2: Palantir (short) vs NVIDIA (long)

Opened (12/18/25)

- Palantir: 185.69 USD (short)

- NVIDIA: 174.14 USD (long)

- Position size: 100 shares per leg

Closed (01/09/26)

- Palantir: 179.49 USD

- NVIDIA: 184.82 USD

Outcome

- Palantir (short): +6.20 USD per share → +620 USD

- NVIDIA (long): +10.68 USD per share → +1,068 USD

Net result: +1,688 USD

This was a clean example of a pair doing exactly what it is supposed to do. Both legs contributed, not because the market moved in one direction, but because relative strength and weakness diverged in a controlled way.

Pair 3: S&P 500 (short) vs Euro Stoxx 50 (long)

https://pro1x.com/symbol/%5EGSPC

https://pro1x.com/symbol/%5ESTOXX50E

Opened (12/18/25)

- S&P 500: 6,774 points (short)

- Euro Stoxx 50: 5,741 points (long)

- Position size: 1 contract per index (10 USD per point)

Closed (01/09/26)

- S&P 500: 6,966 points

- Euro Stoxx 50: 5,997 points

Outcome

- S&P 500 (short): −192 points → −1,920 USD

- Euro Stoxx 50 (long): +256 points → +2,560 USD

Net result: +640 USD

U.S. equities continued to grind higher, but European indices showed enough relative strength for the spread to remain favorable. With the differential largely realized, the trade no longer justified staying open.

Conclusion

Pair trades are not a permanent solution, nor do they work in every market environment. They require patience, context, and a clear plan for exits. In this case, all three structures fulfilled their purpose: capturing relative moves and allowing positions to be closed once the opportunity had largely played out.

Taken together, the three strategies generated a combined result of 4,011 USD. Not through aggressive positioning or bold market calls, but through measured exposure and incremental gains across each pair. The number itself is secondary; what matters is the process behind it.

Pair trading works best when markets are fragmented and narratives diverge. Those conditions won’t always be present — but when they are, it pays to be ready.

If you’d like to receive more market ideas, strategy frameworks, and practical trade setups, consider subscribing to the newsletter (if you haven’t already). Opportunities tend to appear when clarity is scarce and preparation makes all the difference.