The market is starting to show clear signs of fatigue. The big winners are still winners, but with far less conviction and with technical setups that, at the very least, suggest easing off the accelerator.

Leer este artículo en español 🇪🇸

After a remarkable year, the leadership of the “Magnificent Seven” is beginning to crack. Google, Tesla, and Apple are holding up, but the rest look set to finish the year well off their highs, with increasingly fragile technical structures.

A brilliant year… and a dangerously concentrated one

From a market perspective, 2025 has been hard to argue with. Strong returns, fresh all-time highs across major indices, and a compelling narrative that has dominated everything: artificial intelligence as the engine of the next major economic cycle.

Beneath that apparent strength, however, lies a less comfortable reality. Market performance has been extraordinarily concentrated. The bulk of the gains can be explained by a very small group of companies—the now-familiar Magnificent Seven—and, by extension, the semiconductor complex and AI-adjacent businesses.

Nvidia, Microsoft, Apple, Alphabet, Meta, Amazon, and Tesla didn’t just lead the market this year; for long stretches, they were the market. Any headline tied to new data centers, chip investments, or strategic partnerships triggered almost reflexive buying. FOMO ran at full throttle for much of the year.

As the year has progressed, though, the tone has shifted. Not because AI has lost relevance—far from it—but because an uncomfortable question is gaining traction: when will this massive deployment of capital translate into tangible, recurring profits?

The issue isn’t the “what,” but the “when,” and in some cases, the “at what cost.” Investment levels are enormous, CAPEX commitments are stretching balance sheets, and returns remain, for now, more promised than proven. At the same time, valuations have climbed to levels that leave very little room for error.

And markets, when they sense that the margin of safety is shrinking, tend to become far more demanding.

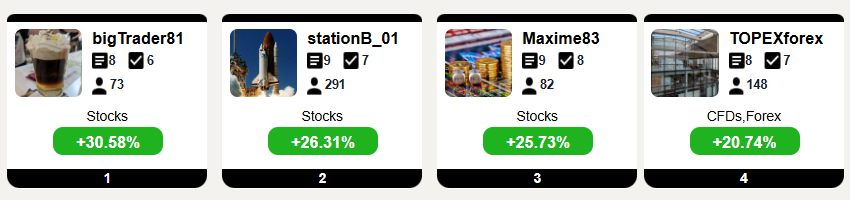

Top Traders League

When the charts start to push back

If there’s one hallmark of late-cycle markets, it’s that price action stops validating the narrative. That’s precisely what we’re beginning to see.

The two undisputed stars of the first half of the year—Nvidia and Microsoft—are closing out 2025 with performance well below what investors had grown accustomed to during the first nine months.

In Nvidia’s case, the technical damage is clear on the weekly chart. The break below the 20-week moving average, following an almost vertical advance, is not a trivial development. Compounding that, the relative strength indicator has rolled over into negative territory versus the broader market. Setups like this are rarely resolved through a brief sideways consolidation.

Figure 1. NVIDIA Corporation (NVDA) weekly closing prices.

Microsoft paints a different picture, but hardly a reassuring one. The stock has confirmed a bearish crossover between its 20- and 50-day moving averages, a classic signal of waning momentum. Price is now approaching a level many portfolio managers view as critical: the 200-day moving average. What matters here isn’t just whether it holds, but how it holds—and with what volume.

Figure 2. Microsoft (MSFT) daily closing prices.

By contrast, Apple and Alphabet currently display more orderly technical profiles. Both remain in intact short- and medium-term uptrends and have yet to violate key levels. Still, early signs of exhaustion are emerging: flatter slopes, difficulty pushing to new highs, and diminishing thrust on rallies.

Figure 3. Alphabet (GOOG) daily closing prices.

The broader message is hard to ignore: the market no longer has the same energy. Rotation into sectors like financials and energy is real, but insufficient to offset weakness in large-cap technology. Without those heavyweights doing the lifting, indices struggle to make meaningful progress.

The S&P 500 and an uncomfortable question

The S&P 500 chart captures the current market moment rather well.

The all-time highs in the 6,900–6,925 area have become a formidable barrier. It’s not just that the index has failed to break through—each attempt has come with noticeably less conviction. That opens the door, still distant but no longer negligible, to a potential double-top formation.

Figure 4. S&P 500 (^GSPC) daily closing prices.

Caution is warranted. The pattern is not confirmed, and the index’s medium-term uptrend remains intact. As long as 6,550 holds, talk of a structural top is premature. More importantly, the key reference support sits near 6,150, corresponding to the first Fibonacci retracement of the last major upswing.

That said, markets rarely issue multiple warnings. A loss of momentum, combined with stretched valuations and increasingly fragile leadership, creates fertile ground for volatility. Not necessarily a full-blown bear market—but certainly a far more uncomfortable environment for those who arrive late or mistake narrative for trend.

Reflection is also an investment decision

In markets, knowing when to stop being aggressive is just as important as knowing when to buy. 2025 has rewarded those who embraced the narrative early. Year-ends, however, are rarely kind to complacency.

This is not a moment of panic, nor one of structural breakdown. It is something subtler—and therefore more dangerous: the shift from euphoria to doubt. A phase in which prices stop rising on inertia and begin demanding justification.

Maybe 2026 will remain bullish. Maybe it won’t. What seems increasingly clear is that the market is no longer writing blank checks. At this stage of the cycle, slowing down, filtering noise, and prioritizing risk management is not a defensive stance—it’s a professional one.

The best investment decisions are rarely made when the market is shouting “buy,” but when it starts to whisper that something has changed.

That’s when it pays to listen.

And that’s where the real work of the investor begins.