From Aaa to Aa1, outlook shifted to stable as deficits and interest costs rise

Moody’s has cut the United States’ long-term rating one notch, from the top-tier Aaa to Aa1, and revised the outlook from negative to stable. The agency cites a decade of widening federal deficits, spiraling interest payments and the lack of bipartisan action to reverse those trends.

The move follows Republican lawmakers’ blockade of President Donald Trump’s latest tax-cut package, aimed at extending the 2017 Tax Cuts and Jobs Act and adding new breaks. Moody’s warns that prolonging those cuts would swell the primary federal deficit by about $4 trillion over the next ten years and leave mandatory spending and overall deficits “materially” higher

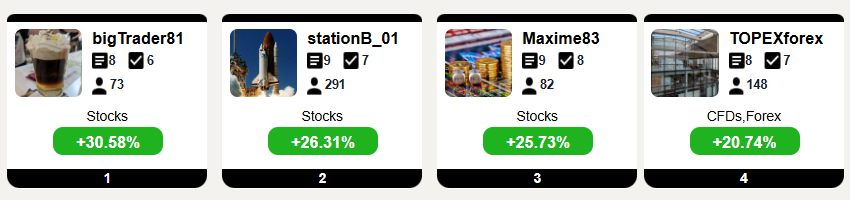

Top Traders League

While Fitch and S&P stripped the U.S. of their highest rating years ago, Moody’s stresses that America still sits near the top of its 21-grade scale thanks to “exceptional credit strengths” — a vast, resilient economy, the U.S. dollar’s reserve-currency status and an independent Federal Reserve. Despite policy uncertainty and institutional challenges, the agency believes the nation’s separation of powers remains broadly stable in the short term.